Legal defense costs can be a major financial burden for businesses, especially in high-risk industries like firearms. These expenses cover attorney fees, court costs, investigations, and other related expenditures when defending against lawsuits or regulatory claims. Without proper insurance, a single lawsuit could severely impact a business's financial stability.

Key Points:

Important Considerations:

To stay protected, firearms businesses should review their policies regularly, invest in employee training, and work with industry-specific insurers to ensure comprehensive coverage and minimize risks.

Commercial General Liability Insurance plays a vital role in covering legal defense costs for firearms businesses. When a claim covered under the policy arises, the insurer steps in to manage settlements and legal expenses. This arrangement shifts the financial burden from the business owner to the insurer, allowing business operations to continue without the strain of overwhelming legal bills. Once the claim is determined to fall within the policy's terms, the insurer typically appoints qualified legal counsel and oversees the defense process.

Joseph Chiarello & Co., Inc. tailors its Commercial General Liability Insurance to meet the specific needs of firearms businesses across the United States. Recognizing the unique challenges faced by gun shops, firearms retailers, and related operations, their policies go beyond standard commercial coverage to provide specialized protection.

A key factor in understanding this type of insurance is knowing how defense costs interact with policy limits.

One critical aspect to consider when choosing liability insurance is whether defense costs fall inside or outside policy limits. This distinction can greatly affect the overall protection available during legal disputes.

For example, let’s say a firearms business has a $1 million liability policy and faces a $200,000 settlement along with $150,000 in legal defense costs. With outside limits coverage, the insurer would cover the full $350,000, leaving the policyholder’s $1 million limit intact for future claims. However, with inside limits coverage, the $150,000 in legal costs would reduce the remaining settlement funds to $850,000.

For firearms businesses, opting for outside limits coverage often makes sense because legal defense costs in this industry can be substantial. Whether dealing with regulatory investigations, product liability claims, or complex premises liability cases, preserving the full policy limits ensures more comprehensive financial protection. While outside limits coverage may come with higher premiums, the added security can be invaluable in the face of significant legal disputes.

Beyond the question of limits, liability insurance also covers a wide range of legal expenses.

Liability insurance provides coverage for various legal expenses incurred when defending against covered claims, offering business owners a clearer picture of the value their policy delivers.

Joseph Chiarello & Co., Inc. ensures that its Commercial General Liability Insurance policies address these categories of legal expenses comprehensively. By understanding the full scope of potential legal costs, firearms businesses can secure the robust protection they need to navigate complex legal challenges with confidence.

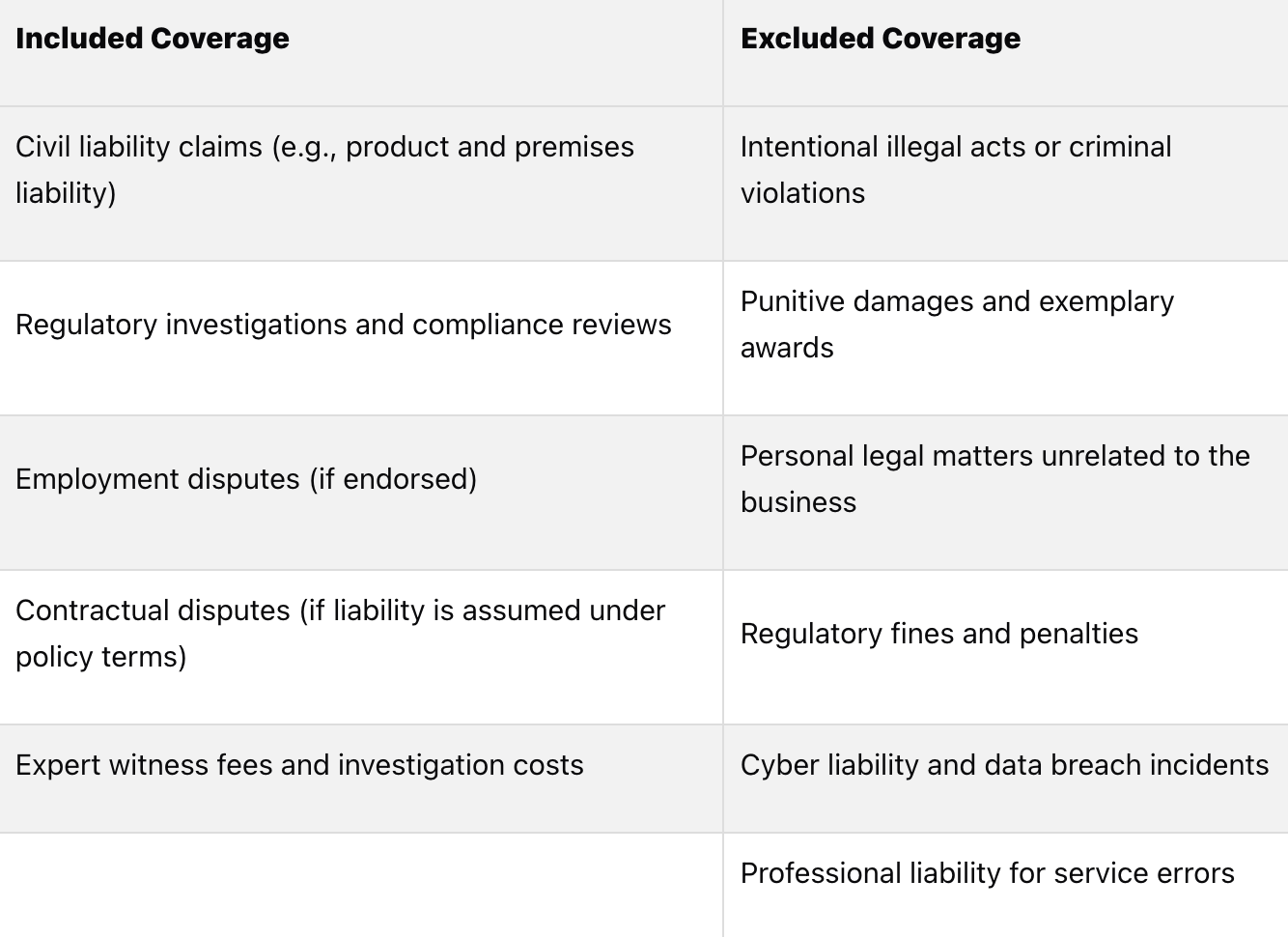

Knowing the boundaries of legal defense coverage is crucial for firearms businesses to manage risks effectively and avoid unexpected expenses. While liability insurance offers a strong safety net, it’s essential to grasp the specifics of what’s covered and what isn’t. Here’s a closer look at the key aspects of included and excluded defense costs.

Liability insurance typically covers a range of legal defense costs, including civil liability claims, regulatory investigations, and certain workplace disputes (with endorsements). Here’s how these areas break down:

Despite the broad protection liability insurance provides, there are clear exclusions you need to be aware of:

Here’s a quick comparison of what’s covered and what’s not:

Partnering with experienced insurance professionals can make navigating these complexities much easier. For example, Joseph Chiarello & Co., Inc. specializes in helping firearms businesses customize their policies to ensure that all potential risks are addressed. This tailored approach ensures businesses understand exactly what’s protected and where additional coverage might be needed.

When it comes to legal defense cost coverage, several key factors come into play. By understanding these, firearms businesses can make smarter decisions about their policies and avoid unwelcome surprises when claims arise.

The structure of your insurance policy determines whether legal defense costs will eat into settlement funds. Policies with inside limits reduce the funds available for settlements dollar-for-dollar. For example, if you spend $300,000 on legal fees under an inside-limits policy, that same amount gets deducted from your settlement pool, potentially creating financial strain during complex lawsuits.

On the other hand, policies with defense costs outside the limits provide separate funds for legal expenses, leaving liability protection untouched. While these policies often come with higher premiums, they offer stronger financial protection during long or complicated legal battles.

Another critical factor is the aggregate limit, which is the maximum amount an insurer will pay for all claims during a policy period. For firearms businesses handling multiple claims in a single year, it’s crucial to know whether defense costs count against this cap. Misunderstanding this detail could leave you exposed to financial risks later.

Your business’s unique characteristics - such as its size, revenue, location, and claims history - can significantly impact your policy limits, premiums, and even your eligibility for coverage. For instance:

Firearms businesses that implement robust safety protocols - such as secure storage procedures and documented employee training - are often seen as lower-risk by insurers. These efforts not only reduce the chance of liability claims but can also result in reduced premiums.

However, failing to comply with regulations, such as those tied to the Federal Firearms License, can limit your coverage options or drive up costs. These business-specific factors highlight the importance of tailoring insurance solutions to your operational needs.

Partnering with a specialized insurance provider offers distinct advantages for managing legal defense costs. Generic policies often include exclusions or limitations that don’t align with the risks firearms businesses face. A tailored approach ensures your coverage addresses these unique challenges.

For example, standard commercial liability policies may exclude firearm-related incidents or use vague language about product liability. Specialized providers craft policies with clear definitions, reducing disputes during claims processing. They also design policies with higher defense cost limits and favorable terms for regulatory investigations, recognizing the complexity of firearms-related litigation.

Beyond coverage, specialized insurers often provide risk management support to help businesses prevent claims in the first place. For instance, Joseph Chiarello & Co., Inc. offers risk assessments to identify potential exposures and recommend preventive measures. This proactive approach can lower both the likelihood of claims and the associated legal costs.

When legal issues do arise, working with a specialized provider ensures access to attorneys experienced in firearms law, regulatory compliance, and product liability. These experts can help resolve cases more efficiently, saving both time and money.

Another key benefit is flexibility. As your business grows or evolves - whether by adding new product lines, opening additional locations, or changing operational practices - a specialized provider can adjust your coverage to keep it aligned with your needs. This adaptability helps prevent gaps or overlaps in protection.

Investing in customized insurance solutions often proves worthwhile. Not only do these policies offer better terms and lower long-term costs, but they also reduce disruptions during legal proceedings. For firearms businesses, this specialized coverage provides peace of mind, ensuring that legal defense costs won’t jeopardize business continuity.

Running a firearms business comes with its share of risks, especially when it comes to legal defense costs. To protect your business from expensive claims, planning ahead is essential. Smart business owners focus on minimizing liability while ensuring their insurance coverage is robust enough to handle potential challenges.

As your business grows and changes, so do your insurance needs. That’s why reviewing your policy annually is a must. Unfortunately, many firearms businesses only discover gaps in their coverage after filing a claim - when it’s too late to make changes.

Schedule a thorough review of your insurance policy at least once a year, ideally before your renewal date. During these reviews, evaluate whether your policy limits align with your current financial risks. For instance, if your revenue has increased, you might need to raise your liability limits. Similarly, changes like launching new product lines, expanding to additional locations, or modifying operations should prompt updates to your coverage.

Pay special attention to how your policy handles legal defense costs. If your business has grown, it might be time to switch from inside-limits coverage (where defense costs reduce your total liability coverage) to outside-limits coverage. While the latter typically comes with a higher premium, it provides better financial protection in the event of complex lawsuits.

Keep detailed records of any operational or regulatory changes that could impact your coverage needs. These records make policy reviews more efficient and ensure you remain compliant with industry regulations.

Of course, insurance is only part of the equation. Pair updated policies with strong risk management practices for a comprehensive approach.

Reducing liability risks starts with proactive measures, and insurers often reward businesses with lower premiums when they implement strong safety protocols and employee training programs.

Establish clear, documented standard operating procedures (SOPs) for every aspect of your business, from handling inventory to interacting with customers. Make sure your employees are well-trained on these procedures, especially for tasks like background checks, customer verification, and firearm transfers. Beyond reducing errors, these SOPs demonstrate your commitment to compliance, which can be crucial during regulatory inspections.

Employee training shouldn’t stop at the basics. Include topics like customer service, conflict resolution, and emergency response. Equip your team to handle challenging situations calmly and professionally, potentially preventing incidents that could lead to liability claims. Regular refresher courses help keep these practices top-of-mind.

Document all training activities - attendance records, training materials, and assessments. These records can serve as evidence of your efforts to manage risks if a claim ever arises.

Conduct regular safety audits to identify and address potential hazards before they escalate. Check that firearms are securely stored, safety equipment is in working order, and emergency procedures are clearly posted. Any issues should be resolved immediately, with corrective actions documented.

Investing in security measures like surveillance cameras, alarm systems, and secure storage solutions can also pay off. Not only do these measures reduce risks of theft or liability, but many insurers offer discounts to businesses with robust security systems.

While these steps go a long way, having an insurance provider that understands the firearms industry can make an even bigger difference.

Not all insurance providers are equipped to handle the unique risks that firearms businesses face. Choosing a provider with expertise in this industry can ensure your coverage is tailored to meet specific challenges while giving you access to valuable resources.

Specialized providers, such as Joseph Chiarello & Co., Inc., understand the complexities of the regulatory environment surrounding firearms businesses. They design policies that address gaps often left by generic commercial liability insurance, ensuring your business is properly protected.

When legal issues arise, these providers often work with attorneys experienced in firearms law and compliance. These specialists are familiar with the nuances of firearms-related cases, which can lead to faster resolutions and potentially lower legal defense costs.

Another advantage of specialized providers is their ability to stay on top of industry trends and regulatory changes. They can recommend policy adjustments as new regulations emerge or as your business evolves, ensuring your coverage remains relevant and effective.

Even the claims process benefits from working with a specialized provider. Generic insurers may struggle with the intricacies of firearms-related claims, causing delays or disputes. In contrast, specialized providers have streamlined processes and understand the urgency of resolving issues that could jeopardize your Federal Firearms License.

Choosing the right provider isn’t just about finding the lowest premium. Specialized insurers like Joseph Chiarello & Co., Inc. often take a partnership approach, supporting firearms businesses through every stage of growth. From adjusting coverage as your needs change to offering ongoing risk management guidance, these providers deliver long-term value that extends beyond basic insurance coverage.

Legal defense costs can pile up quickly, making solid insurance coverage a must-have for firearms businesses.

Commercial General Liability Insurance is often the first line of defense against legal claims. But not all policies are created equal. Some offer inside-limits coverage, where defense costs reduce the total amount available for liability claims. Others provide outside-limits coverage, ensuring your liability protection remains intact even as legal expenses grow.

Typically, these policies cover expenses like attorney fees, court costs, expert witnesses, and investigations. However, they don’t cover everything - criminal defense, intentional acts, and regulatory violations are usually excluded.

When choosing coverage, it’s important to consider your policy limits and the specific risks your business faces. Firearms businesses deal with unique challenges that many general insurance providers may not fully grasp or address properly.

The best protection comes from combining strong insurance coverage with proactive risk management. Regularly reviewing your policy ensures it aligns with your business’s growth and evolving regulations. Additionally, investing in employee training and maintaining documented safety procedures not only reduces liability risks but can also strengthen your defense if a claim arises.

Partnering with specialized insurance providers like Joseph Chiarello & Co., Inc. can offer firearms businesses a distinct edge. These providers understand the nuances of the industry and design policies to fill gaps in standard coverage. Beyond insurance, they also provide expert advice on risk management and claims support tailored specifically to firearms operations.

A well-thought-out insurance strategy safeguards your assets, keeps your business running smoothly during disputes, and provides much-needed peace of mind. By combining tailored coverage with industry expertise, you’re ensuring your business has the financial protection it needs.

When firearms businesses are deciding whether legal defense costs should fall inside or outside policy limits, it's important to consider how each choice impacts their overall insurance protection.

With defense costs inside the policy limits, any legal expenses are subtracted from the total coverage amount. This reduces the funds available to cover potential damages, which can be a challenge for businesses facing high liability risks or operating on tight budgets. Alternatively, when defense costs are outside the policy limits, legal expenses are handled separately, ensuring the full policy limit remains available for damages. However, this option typically comes with higher premiums.

To determine the right fit, businesses should carefully evaluate their liability risks, financial resources, and insurance budget. Striking the right balance between coverage for legal defense and damages is essential to maintain financial stability and long-term security.

Firearms businesses can reduce their liability risks by implementing smart risk management strategies. Some effective steps include offering comprehensive safety training for employees, keeping precise and up-to-date inventory records, regularly reviewing company policies, and using clear, visible safety signage throughout the premises.

By following these practices, businesses can help prevent accidents, lower the chances of theft, and stay aligned with regulations. This not only creates a safer environment but also helps minimize potential legal and financial risks.

Specialized insurance providers recognize the distinct risks and challenges that firearms businesses encounter, including legal liabilities, product-related claims, and strict compliance demands. Unlike general insurers, these providers craft policies specifically to meet the needs of the firearms industry, offering protection that’s much more aligned with the realities of the business.

What sets these insurers apart is their deep knowledge of the firearms sector. They offer tailored coverage options and essential support services, such as legal defense and claims management. This level of personalization not only helps businesses manage financial risks but also equips them to handle legal hurdles with greater confidence - an invaluable advantage in such a high-stakes industry.

Don't wait until it's too late to make sure your gun shop is covered. At Joseph Chiarello & Co., Inc., we’re here to help you navigate the ins and outs of gun shop workers compensation insurance to ensure you're prepared for any noise-related risks, including hearing damage. Reach out to us today to review your current policy or get a customized quote. Protect your team and your business with the right coverage—because their safety is worth it.

Call Now: 800-526-2199. Or submit your inquiry below. We look forward to having the opportunity to work with you!