Operating a shooting range comes with unique risks like accidental injuries, property damage, lead contamination, and legal liabilities. Specialized insurance coverage is essential to protect your business and comply with state requirements. Here's a quick breakdown of key policies:

Choose an insurance provider with firearms industry expertise for tailored policies and smoother claims processes.

Protect your range by combining the right coverage, maintaining safety protocols, and partnering with knowledgeable insurers.

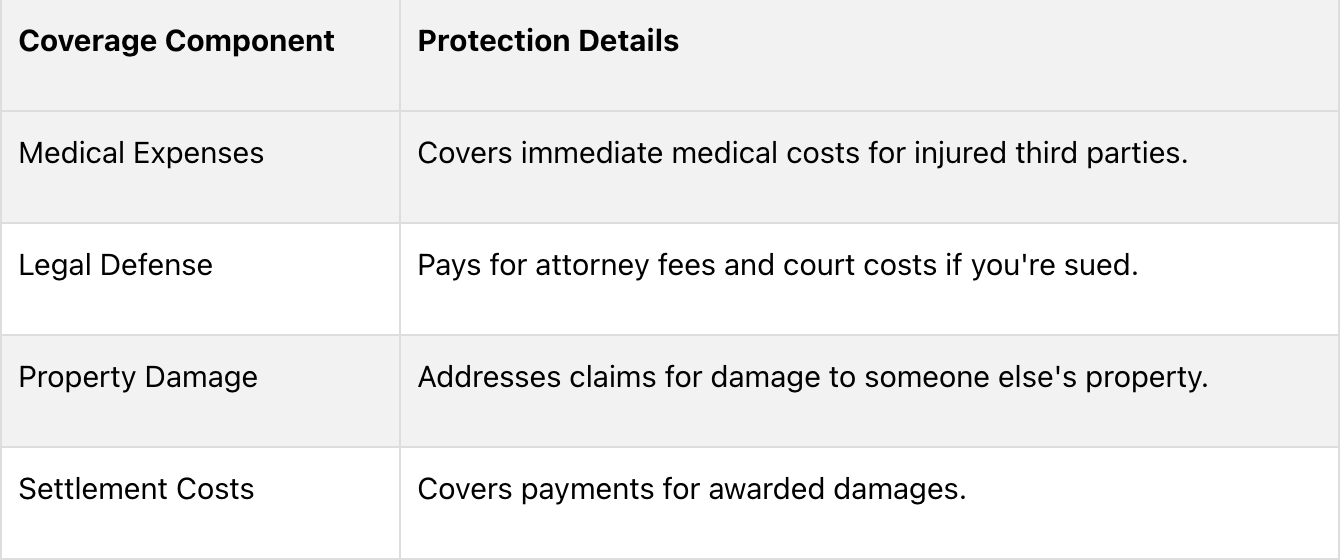

Running a shooting range comes with its share of risks and legal obligations. These essential insurance coverages form the backbone of your risk management strategy. Together, they help safeguard your business from the most common financial and legal challenges.

General liability insurance protects against third-party claims for bodily injury and property damage. For shooting ranges and gun clubs, this type of coverage is often a legal requirement [1].

"You need shooting range liability insurance to help protect you when things go wrong. In life, you will learn how good your insurance partner is when what can happen does happen." - XINSURANCE [4]

Next up is property insurance, which ensures your physical assets are protected.

Property insurance shields your range from losses caused by fire, theft, or natural disasters [8]. This coverage typically includes:

Insurance rates can vary depending on the materials used in your building's construction. Fire-resistant materials often lead to lower premiums, while combustible materials may result in higher costs [7]. Similarly, properties located in areas with strong fire protection services are likely to secure better rates [7].

Workers' compensation coverage, on the other hand, focuses on protecting your team.

Workers' compensation provides coverage for medical expenses, lost wages, and ongoing care if an employee is injured on the job. Filing claims promptly - within 24 hours - can speed up settlements by 59% and often reduce costs [9]. Most states require this coverage, though Texas and New Jersey are exceptions where it remains optional [9].

To ensure compliance and minimize risks, maintain detailed records of:

Failing to carry workers' compensation insurance can result in hefty fines and legal troubles [10]. Partnering with an insurance provider experienced in the shooting sports industry can help you secure the right coverage and stay compliant with state regulations [9].

Shooting ranges face a variety of unique risks that go beyond what standard insurance policies typically cover. To address these specific challenges, additional coverage options are often necessary.

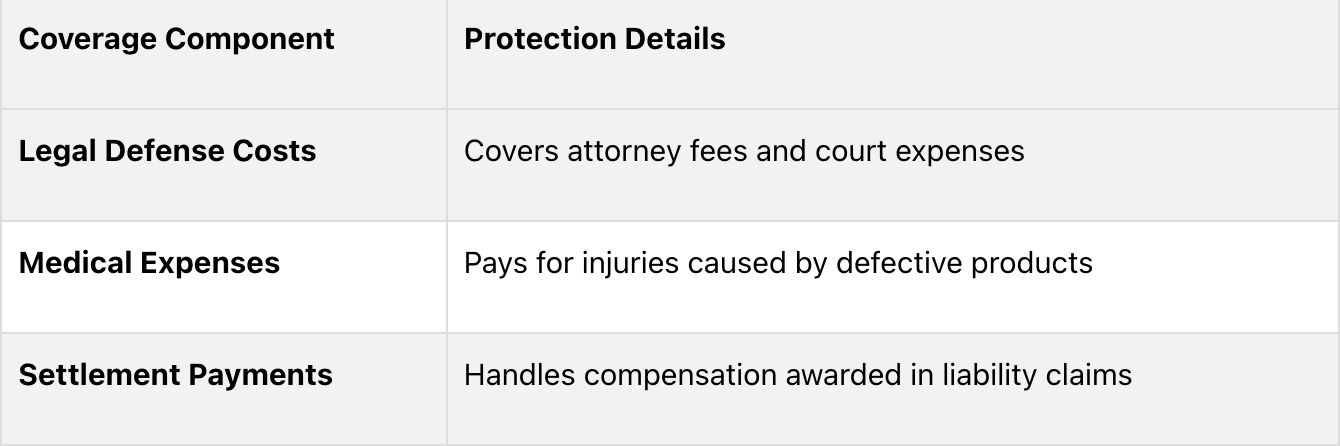

Product liability insurance is designed to protect shooting ranges from legal claims tied to the products they sell or rent. This coverage becomes especially important for ranges that deal with:

For shooting range owners, this type of insurance acts as a buffer against lawsuits stemming from defective or unsafe products. It's worth noting that environmental risks, such as lead exposure, also require specialized coverage.

Lead contamination insurance addresses the environmental risks that come with operating a shooting range, particularly those related to lead exposure. This type of coverage helps with cleanup costs and legal fees arising from pollution claims.

Consider the case of the Douglas Ridge Rifle Club in Eagle Creek, Oregon. In 2010, the club faced environmental contamination claims. A federal district court in Portland ruled that the club's insurance policies should cover claims related to environmental contamination and public nuisance. This case highlights the importance of having appropriate coverage in place [5].

Some insurers even offer policies with high limits - up to $10,000,000 - to help shooting range owners manage claims related to lead hazards, penalties, and cleanup expenses [11].

Extended liability coverage provides an extra layer of protection when standard policy limits are exceeded. This is particularly important for shooting ranges that could face catastrophic events or large-scale liability claims. This coverage can address:

Choosing the right extended liability limits depends on the specific risks associated with your shooting range [8].

Several factors play a role in determining the cost of shooting range insurance, shaping both the premiums and the coverage options. Let’s break down the main elements that influence these expenses.

Where a shooting range is situated can have a major impact on insurance costs. Risk levels and local regulations vary widely depending on the area, and urban or suburban locations often face unique challenges due to nearby residential and commercial development expanding over time [5].

Here are some location-related factors to consider:

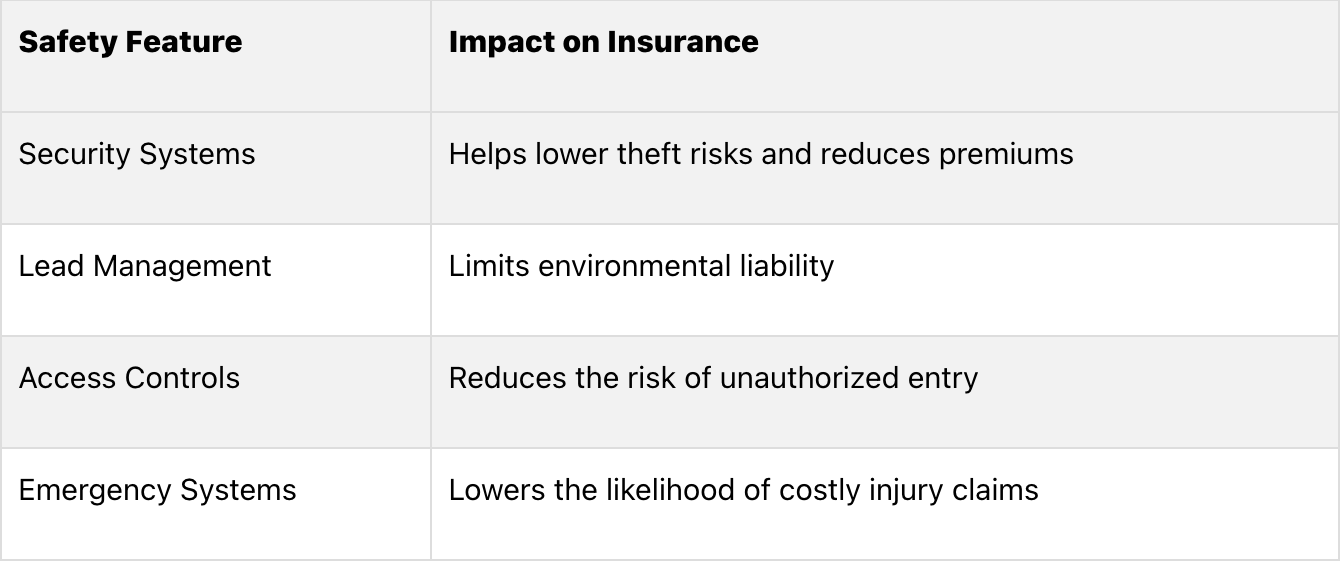

The layout and safety measures of a shooting range can significantly affect insurance premiums. Features like advanced security systems and emergency protocols help reduce risks, which insurers take into account.

The size of the business and the variety of services offered also influence insurance costs. For example, the initial setup for a shooting range - including land, buildings, and equipment - can cost anywhere from $750,000 to $1,500,000. Monthly payroll expenses often range between $30,000 and $50,000 [14].

Other factors include:

Understanding these factors is essential for managing risks effectively and maintaining both financial and operational stability. By addressing these cost drivers, shooting range owners can better protect their businesses while planning for long-term success.

Effective risk management is the backbone of keeping your shooting range safe while controlling insurance costs. Implementing solid safety measures helps prevent claims and ensures smooth operations.

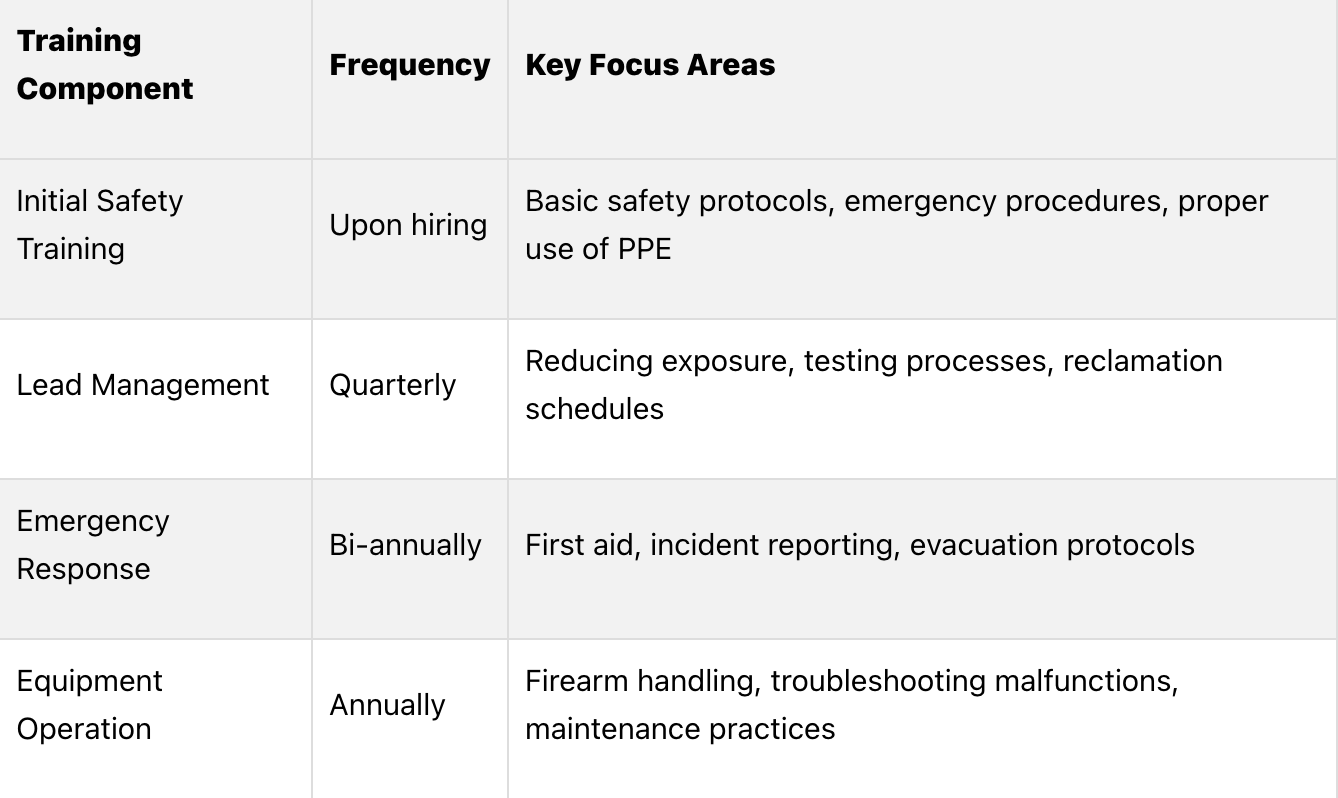

Comprehensive staff training is essential for minimizing risks at shooting ranges. A well-rounded training program should cover all critical aspects of range operations and safety.

"Range owners should be more involved in these seven practices. If ownership does not buy into safety, the range manager will face an uphill battle implementing these must-needed practices." – Mark Rice, Director of Range Operations, The Gallery Sportsman's Club [15]

Keep detailed documentation of all training sessions, including dates, attendees, and topics covered. Use clear, easy-to-understand materials to ensure everyone is on the same page. Pairing training with regular facility inspections can significantly reduce the likelihood of incidents.

Routine inspections and maintenance are key to identifying and addressing potential hazards before they lead to problems.

Daily Inspections:

Monthly Assessments:

Develop written programs for hazard communication, pathogen control, and respiratory protection [16]. Keep thorough records of all maintenance activities and inspection results; this not only ensures compliance with insurance requirements but also creates a safer environment.

In addition to routine checks, having a well-practiced emergency plan is essential for managing risks effectively.

An organized emergency response plan is vital for reducing risks and handling incidents efficiently. Your plan should outline clear procedures for various emergencies.

Key components include defined evacuation routes, a list of emergency contacts, designated first aid stations, and a clear process for documenting incidents. When contacting emergency services, provide detailed information, including the location, nature of the incident, number of people affected, and current safety status.

Keep the plan up-to-date and conduct regular drills to ensure staff are familiar with the procedures. Use feedback from drills and real-life incidents to refine your protocols, ensuring they remain effective and compliant with insurance requirements.

When it comes to managing risks effectively, selecting the right insurance provider plays a key role in ensuring comprehensive coverage for your shooting range. The provider you choose should not only understand your industry but also align with your specific needs and challenges.

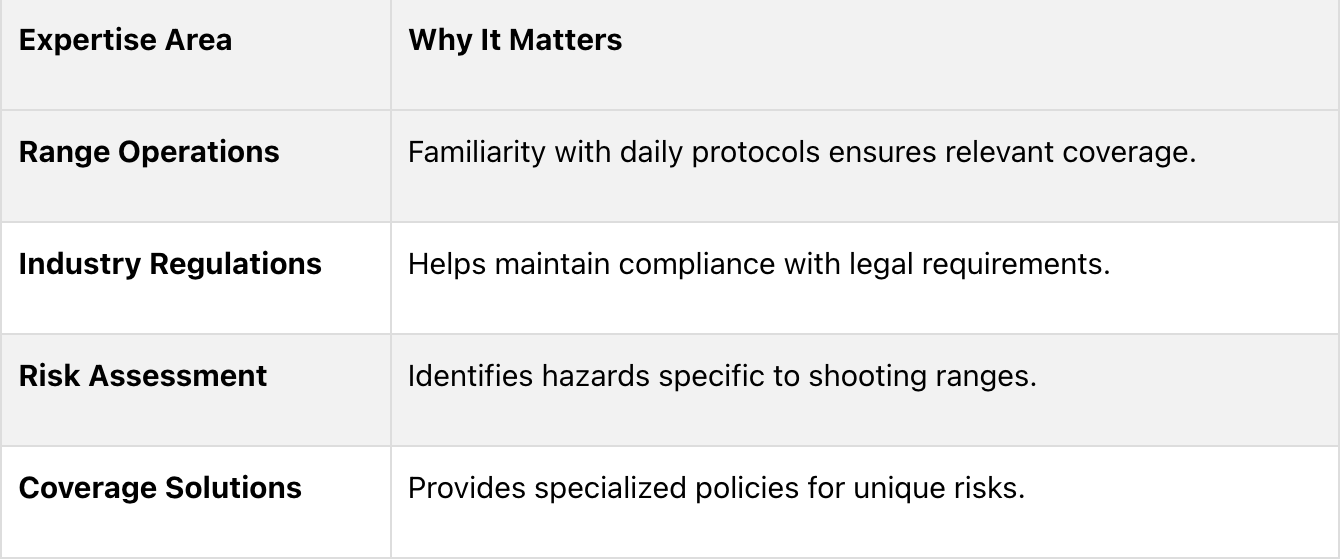

An insurance provider with in-depth knowledge of the firearms industry is invaluable. They can offer tailored solutions that address the unique risks and requirements of shooting ranges. Key areas of expertise to look for include:

"A first class Insurance Broker representing the insured not the insurance company. They are the very best in the business!" - Fritz S. [17]

A knowledgeable provider will also stay updated on industry trends and proactively help you manage risks, ensuring your business is well-protected.

The claims process is your lifeline in the event of an incident. A provider with a streamlined and efficient system can make all the difference during stressful situations. Look for these key features:

"Effective claims processing is crucial. It ensures that policyholders receive timely and fair compensation, essential for maintaining trust and satisfaction with the insurer." [18]

Additionally, choose a provider that invests in training their claims representatives to handle inquiries professionally and resolve issues promptly.

Your insurance coverage should evolve with your business. A flexible insurance provider can adapt policies to meet your shooting range's unique risks and growth. Look for:

Customization Options:

"Their service has been outstanding. I would strongly recommend them to any gun dealer in need of insurance for their business." - Charles K. [17]

Tailored policies ensure your shooting range is protected against specific risks, much like a customized risk management plan does.

When evaluating providers, prioritize those offering comprehensive coverage, including workers' compensation, property insurance, and liability policies designed specifically for shooting ranges. The right provider should act as a partner in safeguarding your business, not just as a seller of policies.

Protecting your shooting range is easier when you follow these steps. With over 40 years of experience, Joseph Chiarello & Co., Inc. specializes in providing insurance tailored specifically for shooting ranges [19].

These actions help ensure long-term security for your business. Available coverage includes range liability protection, equipment breakdown coverage, event insurance, workers' compensation, and property insurance [6].

"We do not just offer insurance; but also elevate your overall business experience. With tailored expertise, proactive risk management, comprehensive coverage options, responsive customer support, and educational resources, we, as a trusted partner, become an integral asset in your journey to create a safe, thriving, and resilient shooting range." - Joseph Chiarello & Co., Inc. [17]

"Their service has been outstanding. I would strongly recommend them to any gun dealer in need of insurance for their business." - Charles K. [17]

As an NSSF-endorsed provider serving all 50 states [20][21], Joseph Chiarello & Co., Inc. is well-equipped to help you secure the right coverage. Their team is ready to guide you through every step of the process [19].

To help bring down insurance costs, shooting ranges can adopt several important safety measures that minimize risks and highlight their focus on safety. Key steps include installing modern security systems, enforcing strict firearm safety rules, and requiring all participants to use eye and ear protection. Regular staff training sessions and emergency drills are equally important to ensure the team is ready to respond effectively if something goes wrong.

Keeping the facility clean and well-organized, ensuring fire extinguishers are easy to access, and placing clear safety signs throughout the range are other practical ways to reduce risks. By implementing these measures, shooting range owners not only create a safer environment but may also qualify for lower insurance premiums.

Lead contamination insurance focuses on covering risks directly linked to lead exposure and contamination. This can include costs for cleanup and legal claims stemming from lead-related incidents. In contrast, general liability insurance provides coverage for third-party claims involving bodily injury and property damage but generally excludes pollution-related issues, such as those caused by lead.

Given that lead contamination is a major concern for shooting ranges, securing both types of insurance is often necessary to ensure thorough financial and legal protection.

When choosing an insurance provider for your shooting range, it's essential to pick one with expertise in the firearms industry. They should have a solid track record of creating policies specifically for shooting ranges and a clear understanding of the unique risks you face, such as liability for accidents or property damage.

It's also important that the provider is knowledgeable about industry regulations and compliance standards. This ensures they can help you stay within legal requirements while safeguarding your business. Seek out providers offering customized coverage options designed to fit your specific needs, giving you thorough protection against potential financial setbacks.

If you're looking for reliable gun business workers comp solutions that actually fit your operation, now’s the time to take the next step. Don’t wait until there’s a problem—get ahead of it with the right coverage and support. We’re here to help firearm businesses across New Jersey stay protected, stay legal, and keep things running smoothly. Reach out today to see how we can help you get set for 2025.

Call Now: 800-526-2199. Or submit your inquiry below. We look forward to having the opportunity to work with you!